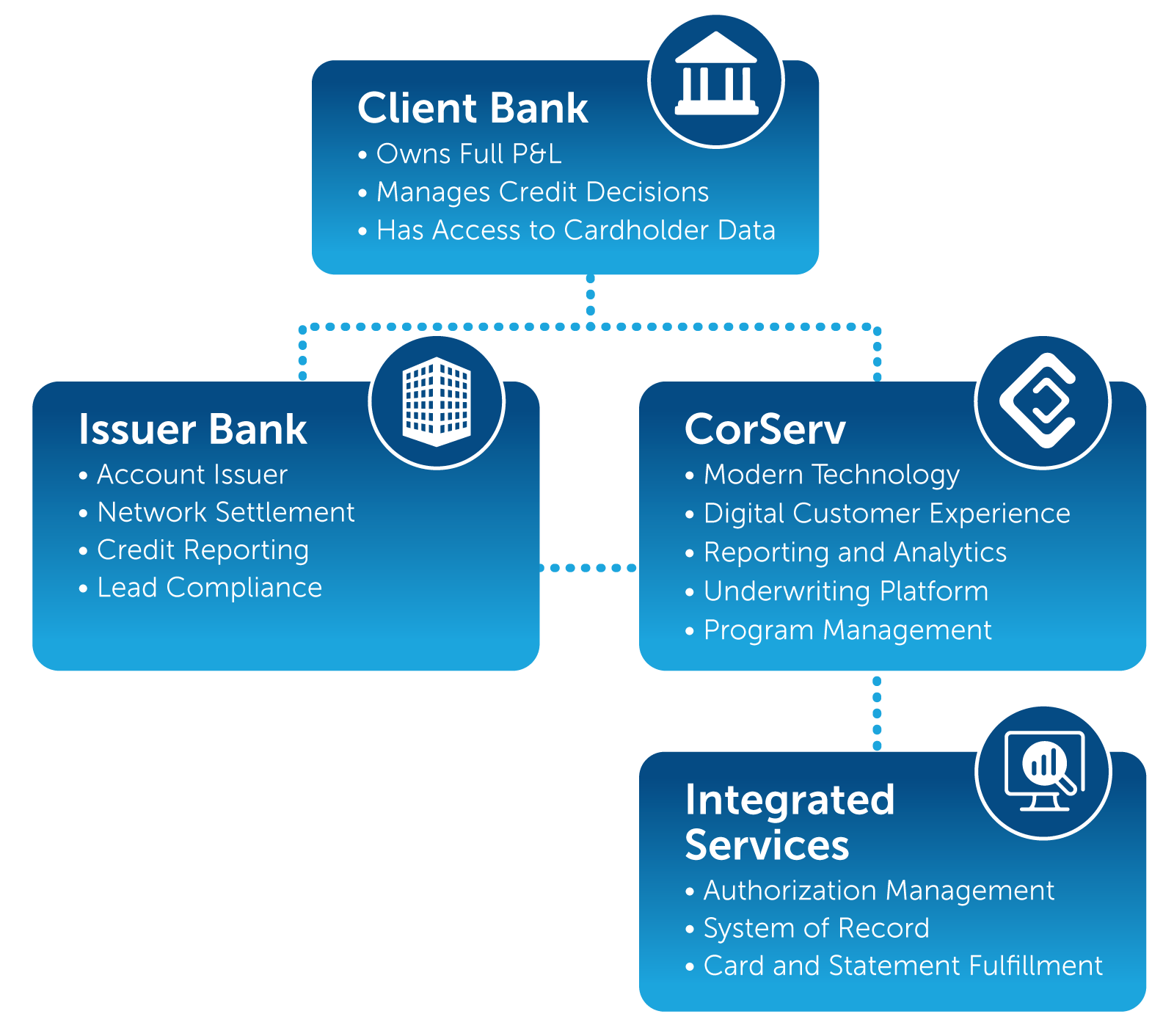

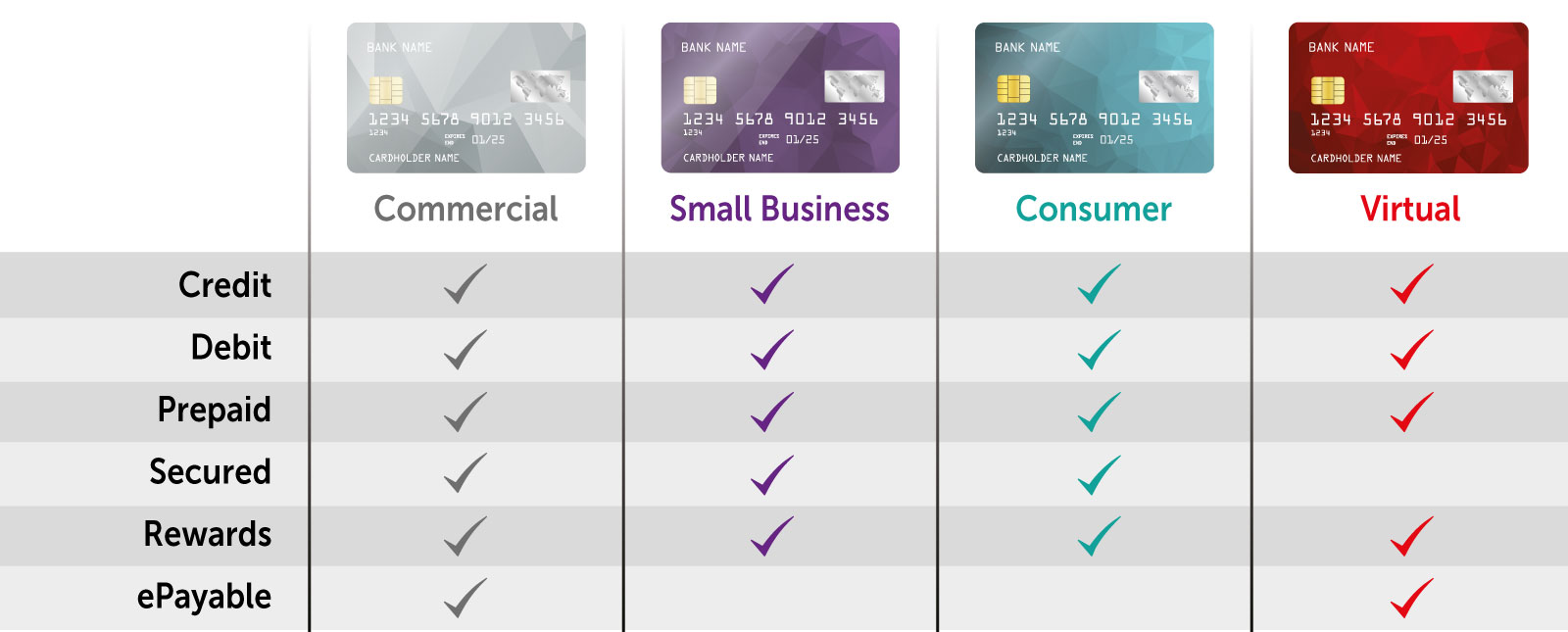

CorServ’s turnkey credit card issuing program enables client banks to offer their own branded credit cards to their businesses and consumers.

Client Banks own the interchange, loan interest, and fee income but with a shared Issuer Bank to support network sponsorship, risk, compliance, and servicing functions. Client Banks review/decision applications that do not reach an automated approval decision and have transparent access to program data and a servicing portal.