Select from CorServ’s carefully pre-defined payment card products based on our years of experience, or partner with us to offer credit card issuing. Card products are branded for you, and card numbers are tokenized. See how CorServ’s platform features can be leveraged with these card products either through our turnkey solutions or by building them through our APIs into your own unique solutions.

Commercial Credit Cards

Commercial credit cards are more sophisticated charge card products that are to be paid in full within 30 days. They are in demand by medium and large companies for employee expenses and vendor payments. A 2023 report by Accenture predicts the commercial payments market will reach $1.26 trillion in revenue by 2028, and CorServ can help your community bank provide excellent credit card issuing to clients.

Corporate

Corporate cards include low APR cards with no rewards and rewards cards. They are often used by medium and large companies, non-profits, and municipalities for employee and business expenses.

Purchasing

Purchasing cards are the fastest-growing type of corporate card. They are often used by medium and large companies, non-profits, and municipalities for employee and business expenses, but also include virtual and ghost cards to support ePayables for vendor invoice payments. They support a customizable rebate feature that provides cash in the amount and on the schedule determined by the issuer.

Fleet

Fleet cards are used by organizations with a fleet of vehicles. They can be driver or vehicle issued and include special features like the ability to enter mileage at the pump and capture gallons, price, grade, pump number, store name, and location with the payment.

ePayables with Virtual and Ghost Cards

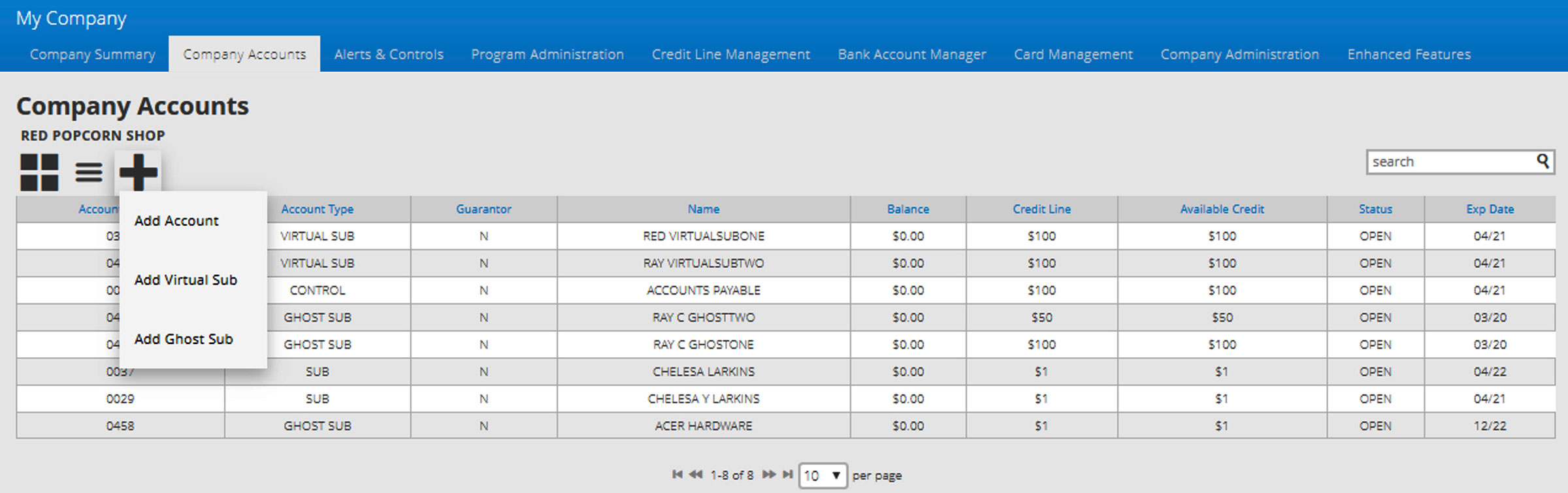

CorServ’s Purchasing Card (Pcard) product includes support for ePayables including virtual and ghost cards. It is the fastest-growing product for banks using CorServ’s credit card issuing programs.

CorServ’s PCard with ePayables Solution Includes:

Traditional Plastic Cards:

- Purchasing for supplies and operations, corporate travel & entertainment expenses

- Company cards assigned to specific employees with individually customized credit limits

- Ghost cards for preferred vendors: plastic-less purchasing card account issued to a specific vendor/supplier, potentially for recurring payments

Virtual Cards for AP invoice settlement:

- Single or limited use virtual card number

- 12 open fields for sending AP data

- Single or bulk card creation (e.g. monthly virtual card run to pay vendors)

- Consolidated for company or individual level billing & payment

- Cashback rewards: Rebates set per customer on purchasing card

- Extensive spend controls and alerts

Business Credit Cards

Business credit cards are revolving cards with variable APRs and credit lines. They are most often used by small businesses that need an average of four cards issued on their credit line. These cards are often guaranteed by one or more owners or executives of the business and leverage their credit score for approval. Business credit cards are available in a variety of types, from low APRs to cards with various rewards options.

Consumer Credit Cards

Most people are very familiar with consumer revolving credit cards with variable APRs and credit lines. Consumer credit cards are available in a variety of types, from low APRs to cards with various rewards options.

Secured Cards

Secured cards are available for consumers and businesses. They work like consumer and business credit cards except the applicant must maintain a deposit account in the amount of the credit line as security against the charges on the card. Secured cards are a great credit builder product for those who do not qualify for a credit card. They are generally offered for low credit lines and their usage is reported to the credit bureaus and can build credit.

Debit Cards

Debit cards are used for making card payments using funds in a bank account owned by the owner of the debit card. The bank account must have enough available funds at the time of the payment to cover the amount of the payment.

Prepaid Cards

Prepaid cards are used for making card payments using funds deposited into a stored value account that are usually held in an aggregate bank account for many prepaid cards. The stored value account must have enough available funds at the time of the payment to cover the amount of the payment. Prepaid cards can be for a fixed amount, such as gift cards, or can be reloadable.